TAXATION (TX) - UK

Syllabus , Core Areas & Examinibility

Syllabus

- Explain the operation and scope of the tax system and the obligations of taxpayers and/or their agents and the implications of non-compliance.

- Explain and compute the income tax liabilities of individuals and the effect of national insurance contributions (NIC) on employees, employers and the self-employed.

- Explain and compute the chargeable gains arising on individuals.

- Explain and compute the inheritance tax liabilities of individuals.

- Explain and compute the corporation tax liabilities of individual companies and groups of companies.

- Explain and compute the effects of value added tax on incorporated and unincorporated businesses.

- Demonstrate employability and technology skills.

Core Areas

- The UK tax system and its administration

- Income tax and NIC liabilities

- Chargeable gains for individuals

- Inheritance tax

- Corporation tax liabilities

- Value added tax (VAT)

Examinability

- The syllabus is assessed by a three-hour computer-based examination.

- All questions are compulsory. The exam will contain both computational and discursive elements.

- Some questions will adopt a scenario/case study approach.

- SECTION A comprises 15 objective test questions (OTQs) of 2 marks each.

- SECTION B comprises 3 objective test cases (OT cases), each of which includes 5 OTQs of 2 marks each.

- SECTION C comprises 1 10-mark and 2 15-mark constructed response (CR) questions.

- The 2 15-mark questions in Section C will focus on Income Tax and Corporation Tax.

- The Section A OTQs, Section B case OTQs and Section C constructed response (CR) question can cover any areas of the syllabus.

Taxation (TX) - DEMO LECTURE

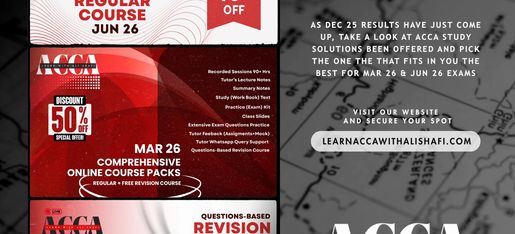

Current Offerings!!

TX (FA24) MARCH 2026 Revision

TX (FA24) MARCH 2026 Regular + Revision

TX (FA24) MARCH 2026 Regular + Revision

TX (FA24) MARCH 2026 Regular + Revision

TX (FA24) MARCH 2026 Regular + Revision

TX (FA24) MARCH 2026 Regular + Revision

TX (FA25) JUNE 2026 Regular

TX (FA24) MARCH 2026 Regular + Revision

TX (FA25) JUNE 2026 Regular

Learn ACCA with Ali SHAFI

Copyright © 2026 Learn ACCA with Ali SHAFI - All Rights Reserved.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.

Upto 50% Off..

ACCA Mar 26 - Revision at 15% Off

ACCA Mar 26 - Regular + Revision at 50% Off

ACCA Jun 26 - Regular at 10% Off